Cryptocurrency platform Bakkt from the operator of the new York stock exchange Intercontinental Exchange (ICE) has successfully closed the first financing round, in which she managed to raise $182,5 million

We are pleased to confirm that we have completed our first round of funding of $182.5 million https://t.co/Cc2EsoQMcT

— Bakkt (@Bakkt) 31 Dec 2018

For example, investors were made by Boston Consulting Group, CMT Digital, Eagle Seven, Galaxy Digital Mike Novogratz, Goldfinch Partners, Horizons Ventures, Intercontinental Exchange, the venture capital division of Microsoft, M12, Pantera Capital, PayU, FINTECH-a division of Naspers, Protocol Ventures and Alan Howard.

As stated in the blog, Bakkt intend to create first regulated exchange for institutional investors in combination with the physical delivery of digital assets and custody services.

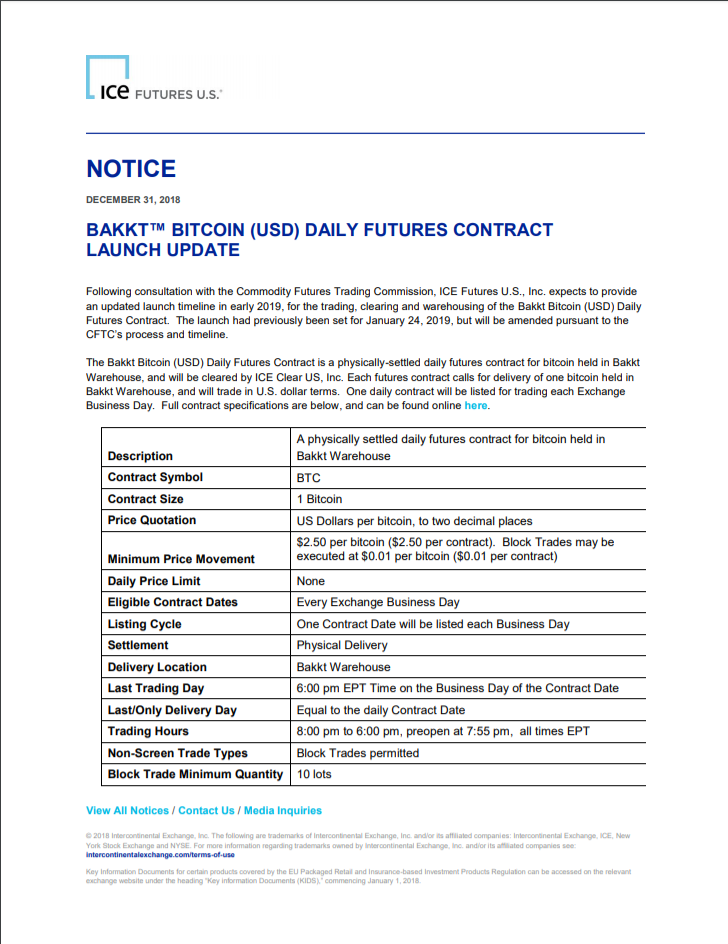

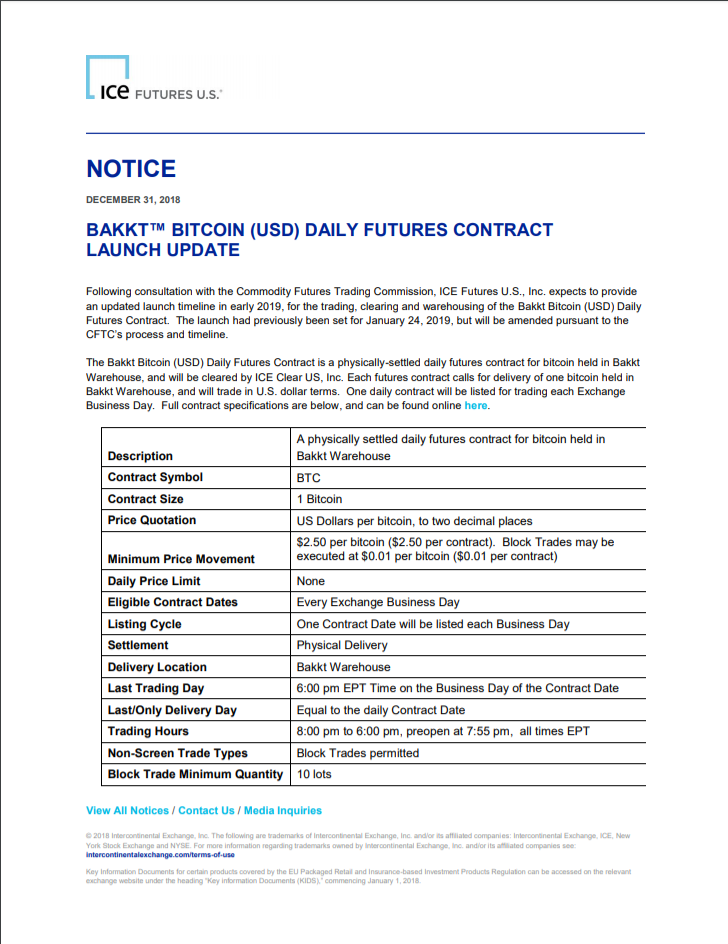

Representatives of the platform interact with the Commission on urgent exchange trade of the USA (CFTC) for a significant part of 2018 and will continue to work on obtaining the necessary permits for the start-up of deliverable bitcoin-futures.

In Bakkt also stressed that many consider the fall of bitcoin prices verdict for the potential of the technology, although no innovation, in their opinion, did not reach its full potential in the first decade.

Meanwhile, in the ICE confirmed that the January 24 launch Bakkt will not take place, because the CFTC has not yet finished. Soon the company’s representatives to clarify the new terms start.

Recall that the launch of Bakkt can postpone, became known on December 22.

Source