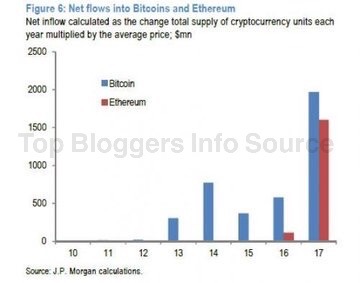

According to a report by JPMorgan, the infusion in Bitcoin only $ 2 billion. in 2017, has raised its capitalization from $ 15 billion. 1.01.2017 to $ 250 billion. by the end of the year.

Thus, Fiat has made 117,5 x’s. @cburniske made in these calculations some of the fixes. According to him, Fiat x 2017 was “in the range of 2-25x depending on assumptions”.

We consider Fiat x’s, since they show relative liquidity. With a relatively large investment in assets with a small market capitalization, expressed in dollars, given the lack of liquidity most of it (lack of assets on the stock exchanges), the price will greatly increase. Fixed offer enhances this effect.

Let us consider this process from a different point of view. If you want to buy 1000 BTC (3.8 million USD). on the spot market Coinbase, you will need to absorb the spread bids and asks that will increase the final cost by 10%. The higher the investment amount, the higher will be the purchase price.

Rating Fiat x’s vary depending on the source:

- JPMorgan: 117x

- Citi: 50x (“for some scriptactive”)

- Burniske: 2x-25x

- Vinny: 5x-10x (https://twitter.com/VinnyLingham/status/1080927987506208768)

The presence of the Fiat x is not a negative factor. They just exist and work in both directions (bullish and bearish inflows outflows). More precisely the situation can be evaluated if we had access to data from Coinbase. Fiat x’s have all the assets.

Given the commitment of market participants to hold coins and the fact that the most active trade was conducted in late 2017, the calculation result of the Fiat x JPMorgan seriously *exceeds* the real figure. I think their logic was the following:

#1 Sold BTC equal to the BTC bought

Assumptions:

#2 Sold sold BTC is all mined BTC

#3 the Price of BTC is the average market price for the year

Disadvantages:

- Holding the coins was not considered

- Used average prices

Many Bitcoin holders sold their coins in 2017, and the largest trading volumes were closer to the end of the year at higher prices.

Source